History

1995

Ignacio Garrido, founder and Chief Investment Officer of Grantia Capital begins to manage his wealth, generated with his earnings as a professional golf player, investing it in the stock market and begins to build mathematical and statistical models to protect each position against extreme movements. It is the origin of everything… the same philosophy remains today in all our strategies.

In 1997 Ignacio is part of the European Ryder Cup Team.

2003

Ignacio’s investment portfolio has generated such good results that a bank offers him to set up a team of mathematicians to develop strategies. But it is precisely that year when Ignacio wins the PGA at Wentworth and decides to continue with his sports career.

2010

An unfortunate illness forces Ignacio to quit golf. This is when the currencies strategy takes its first steps, as Ignacio begins the mathematical study and the construction of the statistical FX model.

2013

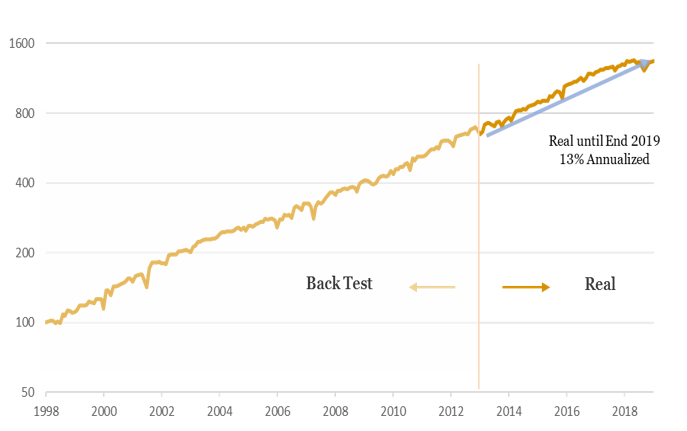

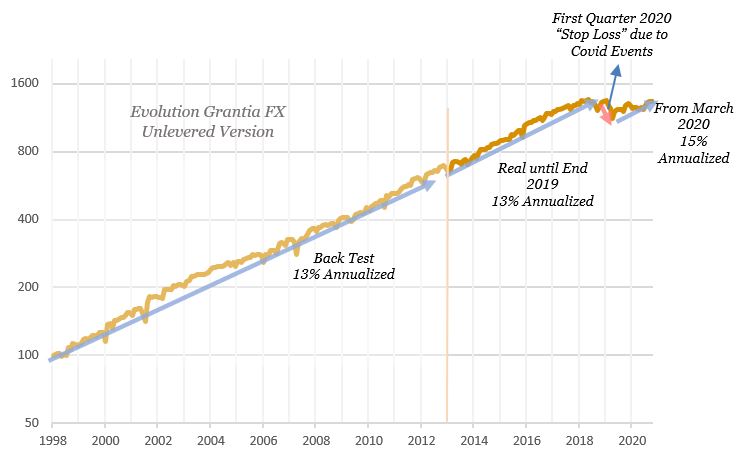

The first version of the model is finalized, and a back-test of the strategy is calculated. Ignacio begins to manage his own financial assets under the model. The first investment professionals join the project, structured as a small family office focused on the management of Ignacio’s financial wealth

2015

In view of the gradual increase in interest shown by investors, as well as the favorable results of the strategy, the professionalization of the team continues, reaching a number of 6 people and expanding its experience in the provision of financial services by reaching an agency agreement with a Spanish financial institution.

2017

Authorization and registration with the Spanish CNMV of GRANTIA CAPITAL SGIIC, S.A. and launch of the first harmonized fund (UCITS) domiciled in Luxembourg under an investment policy implementing the strategy. The team grows to 10 people. The strategy continues to produce very favorable results. Throughout the years of operation, the management team is confronted with events that test the strength of the model such as the withdrawal of the CHF floor against the EUR or the referendum and subsequent exit of the United Kingdom from the EU (“Brexit”).

2018

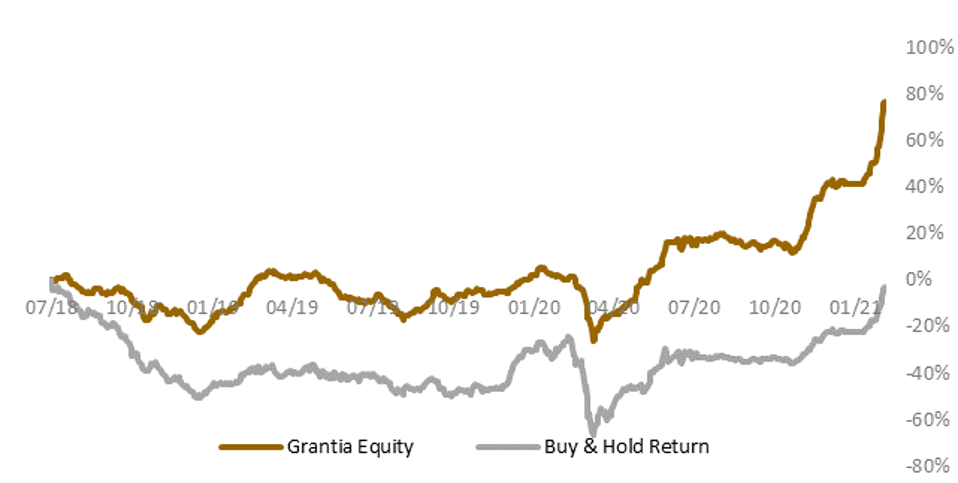

The team at Grantia Capital starts to manage an equity portfolio with 150 randomly chosen stocks. This is the beginning of our Equity Strategy. The portfolio has markedly outperformed its Buy & Hold equivalent during the years. These are the initial stages of our Equity Strategy.

2019

The range of products continues to grow to meet the diverse profiles and risk appetites of investors, the first alternative investment fund (AIF) with Luxembourg SIF format is launched, as well as the first Spanish harmonized fund, with different leverage levels than the base strategy.

The strategy becomes 6 years old and has performed in line with expectations. All of the combinations/slots of risk have returned positively since inception and the strategy’s annualized return is 13%. The first institutional clients invest in the FX strategy.

New senior professionals join the team, which becomes 21 people.

2020

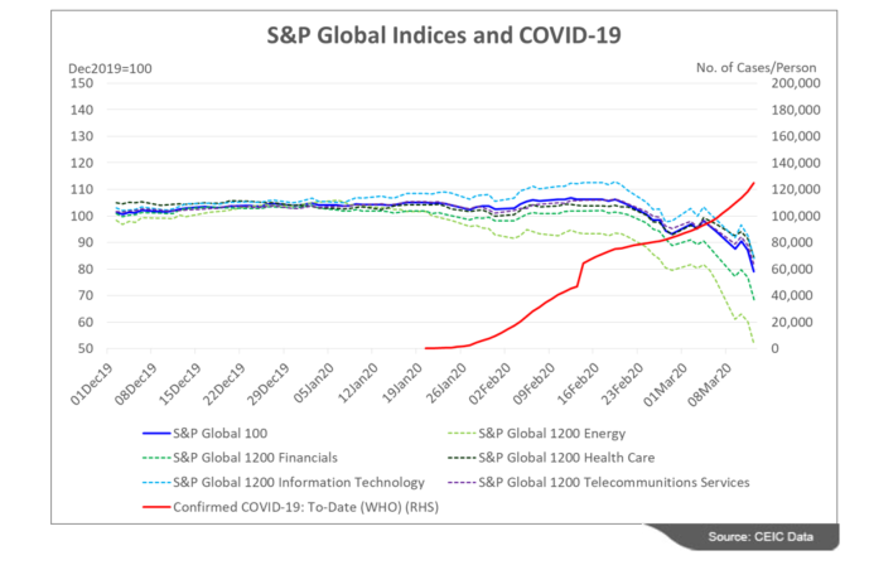

The outbreak of the Covid-19 pandemic and its impact on the financial markets in March 2020 caused a statistical tail event, which resulted for the first time in 5 of the strategy’s combinations entering into stop loss in the month of March. Faced with the confinement situation caused by Covid-19, the operational plan is works perfectly, and the company is maintaining 100% of all processes. In addition, the team is redoubling its efforts, making great progress in the risk control and order execution processes.

2021

The strengthened risk management of the strategy has a favorable impact on the annualized return of the strategy, which reaches new maximums just a few quarters after the Covid statistical event. Launch of the FX strategy under the DB Select Platform.

We open the Equity strategy to investors through the launch a Spanish Harmonized Fund.

@GrantiaCapital

@GrantiaCapital  @GrantiaCapital

@GrantiaCapital